As the twenties roared on, a market crash became inevitable. Why? And who should have stopped it?

-

August 1958

Volume9Issue5

The decade of the twenties, or more precisely the eight years between the postwar depression of 1920–21 and the stock market crash in October of 1929, were prosperous ones in the United States. The total output of the economy increased by more than 50 per cent. The preceding decades had brought the automobile; now came many more and also roads on which they could be driven with reasonable reliability and comfort, There was much building. The downtown section o[ the mid-continent city—Des Moines, Omaha, Minneapolis—dates from these years. It was then, more likely than not, that what is still the leading hotel, the tallest office building, and the biggest department store went up. Radio arrived, as of course did gin and jazz.

These years were also remarkable in another respect, for as time passed it became increasingly evident that the prosperity could not last. Contained within it were the seeds of its own destruction. The country was heading into the gravest kind of trouble. Herein lies the peculiar fascination of the period for a study in the problem of leadership. For almost no steps were taken during these years to arrest the tendencies which were obviously leading, and did lead, to disaster.

At least four things were seriously wrong, and they worsened as the decade passed. And knowledge of them does not depend on the always brilliant assistance of hindsight. At least three of these Haws were highly visible and widely discussed. In ascending order, not of importance but of visibility, they were as follows:

First, income in these prosperous years was being distributed with marked inequality. Although output per worker rose steadily during the period, wages were fairly stable, as also were prices. As a result, business profits increased rapidly and so did incomes of the wealthy and the well-to-do. This tendency was nurtured by assiduous and successful efforts of Secretary of the Treasury Andrew W. Mellon to reduce income taxes with special attention to the higher brackets. In 1929 the 5 per cent of the people with the highest incomes received perhaps a third of all personal income. Between 1919 and 1929 the share of the one per cent who received the highest incomes increased by approximately one-seventh. This meant that the economy was heavily and increasingly dependent on the luxury consumption ot the well-to-do and on their willingness to reinvest what they did not or could not spend on themselves. Anything that shocked the confidence of the rich either in their personal or in their business future would have a bad effect on total spending and hence on the behavior of the economy.

This was the least visible flaw. To be sure, farmers, who were not participating in the general advance, were making themselves heard; and twice during the period the Congress passed far-reaching relief legislation which was vetoed by Coolidge. But other groups were much less vocal. Income distribution in the United States had long been unequal. The inequality of these years did not seem exceptional. The trade-union movement was also far from strong. In the early twenties the steel industry was still working a twelve-hour day and, in some jobs, a seven-day week. (Every two weeks when the shift changed a man worked twice around the clock.) Workers lacked the organization or the power to deal with conditions like this; the twelve-hour day was, in fact, ended as the result of personal pressure by President Harding on the steel companies, particularly on Judge Elbert H. Gary, head of the United States Steel Corporation. Judge Gary’s personal acquaintance with these working conditions was thought to be slight, and this gave rise to Benjamin Stolberg’s now classic observation that the Judge “never saw a blast furnace until his death.” In all these circumstances the increasingly lopsided income distribution did not excite much comment or alarm. Perhaps it would have been surprising if it had.

But the other three flaws in the economy were far less subtle. During World War I the United States ceased to be the world’s greatest debtor country and became its greatest creditor. The consequences of this change have so often been described that they have the standing of a cliché. A debtor country could export a greater value of goods than it imported and use the difference for interest and debt repayment. This was what we did before the war. But a creditor must import a greater value than it exports if those who owe it money are to have the wherewithal to pay interest and principal. Otherwise the creditor must either forgive the debts or make new loans to pay off the old.

During the twenties the balance was maintained by making new foreign loans. Their promotion was profitable to domestic investment houses. And when the supply of honest and competent foreign borrowers ran out, dishonest, incompetent, or fanciful borrowers were invited to borrow and, on occasion, bribed to do so. In 1927 Juan Leguia, the son of the then dictator of Peru, was paid $450,000 by the National City Company and J. & W. Seligman for his services in promoting a $50,000,000 loan to Peru which these houses marketed. Americans lost and the Peruvians didn’t gain appreciably. Other Latin American republics got equally dubious loans by equally dubious devices. And, for reasons that now tax the imagination, so did a large n timber of German cities and municipalities. Obviously, once investors awoke to the character of these loans or there was any other shock to confidence, they would no longer be made. There would be nothing with which to pay the old loans. Given this arithmetic, there would be either a sharp reduction in exports or a wholesale default on the outstanding loans, or more likely both. Wheat and cotton farmers and others who depended on exports would suffer. So would those who owned the bonds. The buying power of both would be reduced. These consequences were freely predicted at the time.

The second weakness of the economy was the large-scale corporate thimblerigging that was going on. This took a variety of forms, of which by far the most common was the organization of corporations to hold stock in yet other corporations, which in turn held stock in yet other corporations. In the case of the railroads and the utilities, the purpose of this pyramid of holding companies was to obtain control of a very large number of operating companies with a very small investment in the ultimate holding company. A $100,000,000 electric utility, of which the capitalization was represented half by bonds and hall by common stock, could be controlled with an investment of a little over $25,000,000—the value of just over half the common stock. Were a company then formed with the same capital structure to hold this $25,000,000 worth of common stock, it could be controlled with an investment of $6,250,000. On the next round the amount required would be less than $2,000,000. That $2,000,000 would still control the entire $100,000,000 edifice. By the end of the twenties, holding-company structures six or eight tiers high were a commonplace. Some of them—the utility pyramids of Insull and Associated Gas & Electric, and the railroad pyramid of the Van Sweringens—were marvelously complex, it is unlikely that anyone fully understood them or could.

In other cases companies were organized to hold securities in other companies in order to manufacture more securities to sell to the public. This was true of the great investment trusts. During 1929 one investment house, Goldman, Sachs & Company, organized and sold nearly a billion dollars’ worth of securities in three interconnected investment trusts—Goldman Sachs Trading Corporation; Shenandoah Corporation; and Blue Ridge Corporation. All eventually depreciated virtually to nothing.

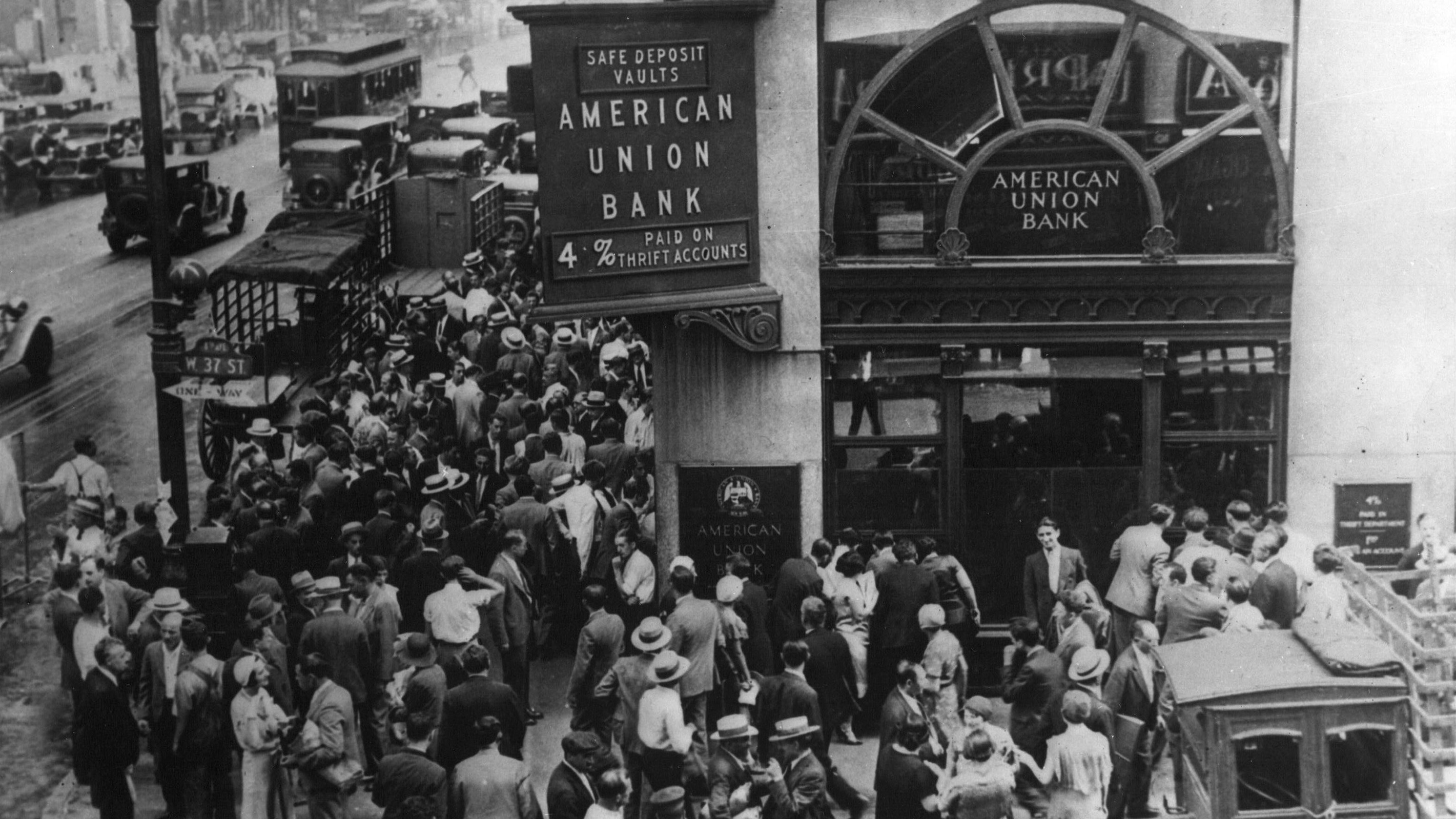

This corporate insanity was also highly visible. So was the damage. The pyramids would last only so long as earnings of the company at the bottom were secure. If anything happened to the dividends of the underlying company, there woidd be trouble, for upstream companies had issued bonds (or in practice sometimes preferred stock) against the dividends on the stock of the downstream companies. Once the earnings stopped, the bonds would go into default or the preferred stock would take over and the pyramid would collapse. Such a collapse would h;ivc a bad effect not only on die orderly prosecution of business and investment by the operating companies but also on confidence, investment, and spending by the community at large. The likelihood was increased because in any number of cities—Cleveland, Detroit, and Chicago were notable examples—the banks were deeply committed to these pyramids or had fallen under the control of the pyramiders.

Finally, and most evident of all, there was the stock market boom. Month after month and year after year the great bull market of the twenties roared on. Sometimes there were setbacks, but more often there were fantastic forward surges. In May of 1921 the New York Times industrials stood at 106; by the end of the year they were 134; by the end of 1925 they were up to 181. In 1927 the advance began in earnest—to 245 by the end of that year and on to 331 by the end of 1928. There were some setbacks in early 1929, but then came the fantastic summer explosion when in a matter of three months the averages went up another 110 points. This was the most frantic summer in our financial history. By its end, stock prices had nearly quadrupled as compared with four years earlier. Transactions on the New York Stock Exchange regularly ran to 5,000,000 or more shares a day. Radio Corporation of America went to 573¾ (adjusted) without ever having paid a dividend. Only the hopelessly eccentric, so it seemed, held securities for their income. What counted was the increase in capital values.

And since capital gains were what counted, one could vastly increase his opportunities by extending his holdings with borrowed funds—by buying on margin. Margin accounts expanded enormously, and from all over the country—indeed from all over the world—money poured into New York to finance these transactions. During the summer, brokers’ loans increased at the rate of $400,000,000 a month. By September they totaled more than $7,000,000,000. The rate of interest on these loans varied from 7 to 12 per cent and went as high as 15.

This boom was also inherently self-liquidating. It could last only so long as new people, or at least new money, were swarming into the market in pursuit of the capital gains. This new demand bid up the stocks and made the capital gains. Once the supply of new customers began to falter, the market would cease to rise. Once the market stopped rising, some, and perhaps a good many, would start to cash in. If you are concerned with capital gains, you must get them while the getting is good. But the getting may start the market down, and this will one day be the signal for much more selling—both by those who are trying to get out and those who are being forced to sell securities that are no longer safely margined. Thus it was certain that the market would one day go down, and far more rapidly than it went up. Down it went with a thunderous crash in October of 1929. In a series of terrible days, of which Thursday, October 24, and Tuesday, October 29, were the most terrifying, billions in values were lost, and thousands of speculators—they had been called investors—were utterly and totally ruined.

This too had far-reaching effects. Economists have always deprecated the tendency to attribute too much to the great stock market collapse of 1929: this was the drama; the causes of the subsequent depression really lay deeper. In fact, the stock market crash was very important. It exposed the other weakness of the economy. The overseas loans on which the payments balance depended came to an end. The jerry-built holding-company structures came tumbling down. The investment-trust stocks collapsed. The crash put a marked crimp on borrowing for investment and therewith on business spending. It also removed from the economy some billions of consumer spending that was either based on, sanctioned by, or encouraged by the fact that the spenders had stock market gains. The crash was an intensely damaging thing.

And this damage, too, was not only foreseeable but foreseen. For months the speculative frenzy had all but dominated American life. Many times before in history—the South Sea Bubble, John Law’s speculations, the recurrent real-estate booms of the last century, the great Florida land boom earlier in the same decade—there had been similar frenzy. And the end had always come, not with a whimper but a bang. Many men, including in 1929 the President of the United States, knew it would again be so.

The increasingly perilous trade balance, the corporate buccaneering, and the Wall Street boomalong with the less visible tendencies in income distribution—were all allowed to proceed to the ultimate disaster without effective hindrance. How much blame attaches to the men who occupied the presidency?

Warren G. Harding died on August 2, 1923. This, as only death can do, exonerates him. The disorders that led eventually to such trouble had only started when the fatal blood clot destroyed this now sad and deeply disillusioned man. Some would argue that his legacy was bad. Harding had but a vague perception of the economic processes over which he presided. He died owing his broker $180,000 in a blind account—he had been speculating disastrously while he was President, and no one so inclined would have been a good bet to curb the coming boom. Two of Harding’s Cabinet officers, his secretary of the interior and his attorney general, were to plead the Fifth Amendment when faced with questions concerning their official acts, and the first of these went to jail. Harding brought his fellow townsman Daniel R. Crissinger to be his comptroller of the currency, although he was qualified for this task, as Samuel Hopkins Adams has suggested, only by the fact that he and the young Harding had stolen watermelons together. When Crissinger had had an ample opportunity to demonstrate his incompetence in his first post, he was made head of the Federal Reserve System. Here he had the central responsibility for action on the ensuing boom. Jack Dempsey, Paul Whiteman, or F. Scott Fitzgerald would have been at least equally qualified.

Yet it remains that Harding was dead before the real trouble started. And while he left in office some very poor men, he also left some very competent ones. Charles Evans Hughes, his secretary of state; Herbert Hoover, his secretary of commerce; and Henry C. Wallace, his secretary of agriculture, were public servants of vigor and judgment.

The problem of Herbert Hoover’s responsibility is more complicated. He became President on March 4, 1929. At first glance this seems far too late for effective action. By then the damage had been done, and while the crash might come a little sooner or a little later, it was now inevitable. Yet Hoover’s involvement was deeper than this—and certainly much deeper than Harding’s. This he tacitly concedes in his memoirs, for he is at great pains to explain and, in some degree, to excuse himself.

For one thing, Hoover was no newcomer to Washington. He had been secretary of commerce under Harding and Coolidge. He had also been the strongest ligure (not entirely excluding the President) in both Administration and party for almost eight years. He had a clear view of what was going on. As early as 1922, in a letter to Hughes, he expressed grave concern over the quality of the foreign loans that were being floated in New York. He returned several times to the subject. He knew about the corporate excesses. In the latter twenties he wrote to his colleagues and fellow officials (including Crissinger) expressing his grave concern over the Wall Street orgy. Yet he was content to express himself—to write letters and memoranda, or at most, as in the case of the foreign loans, to make an occasional speech. He could with propriety have presented his views of the stock market more strongly to the Congress and the public. He could also have maintained a more vigorous and persistent agitation within the Administration. He did neither. His views of the market were so little known that it celebrated his election and inauguration with a great upsurge. Hoover was in the boat and, as he himself tells, he knew where it was headed. But, having warned the man at the tiller, he rode along into the reef.

And even though trouble was inevitable, by March, 1929, a truly committed leader would still have wanted to do something. Nothing else was so important. The resources of the Executive, one might expect, would have been mobilized in a search for some formula to mitigate the current frenzy and to temper the coming crash. The assistance of the bankers, congressional leaders, and the Exchange authorities would have been sought. Nothing of the sort was done. As secretary of commerce, as he subsequently explained, he had thought himself frustrated by Mellon. But he continued Mellon in office. Henry M. Robinson, a sympathetic Los Angeles banker, was commissioned to go to New York to see his colleagues there and report. He returned to say that the New York bankers regarded things as sound. Richard Whitney, the vice-president of the Stock Exchange, was summoned to the White House for a conference on how to curb speculation. Nothing came of this either. Whitney also thought things were sound.

Both Mr. Hoover and his official biographers carefully explained that the primary responsibility for the goings on in New York City rested not with Washington but with the governor of New York State. That was Franklin D. Roosevelt. It was he who failed to rise to his responsibilities. The explanation is far too formal. The future of the whole country was involved. Mr. Hoover was the President of the whole country. If he lacked authority commensurate with this responsibility, he could have requested it. This, at a later date, President Roosevelt did not hesitate to do.

Finally, while by March of 1929 the stock market collapse was inevitable, something could still be done about the other accumulating disorders. The balance of payments is an obvious case. In 1931 Mr. Hoover did request a one-year moratorium on the inter-Allied (war) debts. This was a courageous and constructive step which came directly to grips with the problem. But the year before, Mr. Hoover, though not without reluctance, had signed the Hawley-Smoot tariff. “I shall approve the Tariff Bill.…It was undertaken as the result of pledges given by the Republican Party at Kansas City. … Platform promises must not be empty gestures.” Hundreds of people—from Albert H. Wiggin, the head of the Chase National Bank, to Oswald Garrison Villard, the editor of the Nation —felt that no step could have been more directly designed to make things worse. Countries would have even more trouble earning the dollars of which they were so desperately short. But Mr. Hoover signed the bill.

Anyone familiar with this particular race of men knows that a dour, flinty, inscrutable visage such as that of Calvin Coolidge can be the mask for a calm and acutely perceptive intellect. And he knows equally that it can conceal a mind of singular aridity. The difficulty, given the inscrutability, is in knowing which. However, in the case of Coolidge the evidence is in favor of the second. In some sense, he certainly knew what was going on. He would not have been unaware of what was called the Coolidge market. But he connected developments neither with the well-being of the country nor with his own responsibilities. In his memoirs Hoover goes to great lengths to show how closely he was in touch with events and how clearly he foresaw their consequences. In his Autobiography , a notably barren document, Coolidge did not refer to the accumulating troubles. He confines himself to such unequivocal truths as “Every day of Presidential life is crowded with activities” (which in his case, indeed, was not true); and “The Congress makes the laws, but it is the President who causes them to be executed.”

At various times during his years in office, men called on Coolidge to warn him of the impending trouble. And in 1927, at the instigation of a former White House aide, he sent for William Z. Ripley of Harvard, the most articulate critic of the corporate machinations of the period. The President became so interested that he invited him to stay for lunch, and listened carefully while his guest outlined (as Ripley later related) the “prestidigitation, double-shuffling, honey-fugling, hornswoggling, and skulduggery” that characterized the current Wall Street scene. But Ripley made the mistake of telling Coolidge that regulation was the responsibility of the states (as was then the case). At this intelligence Coolidge’s face lit up and he dismissed the entire matter from his mind. Others who warned of the impending disaster got even less far.

And on some occasions Coolidge added fuel to the fire. If the market seemed to be faltering, a timely statement from the White House—or possibly from Secretary Mellon—would often brace it up. William Allen White, by no means an unfriendly observer, noted that after one such comment the market staged a 26-point rise. He went on to say that a careful search “during these halcyon years…discloses this fact: Whenever the stock market showed signs of weakness, the President or the Secretary of the Treasury or some important dignitary of the administration…issued a statement. The statement invariably declared that business was ‘fundamentally sound,’ that continued prosperity had arrived, and that the slump of the moment was ‘seasonal.’”

Such was the Coolidge role. Coolidge was fond of observing that “if you see ten troubles coming down the road, you can be sure that nine will run into the ditch before they reach you and you have to battle with only one of them.” A critic noted that “the trouble with this philosophy was that when the tenth trouble reached him he was wholly unprepared.…The outstanding instance was the rising boom and orgy of mad speculation which began in 1927.” The critic was Herbert Hoover.

Plainly, in these years, leadership failed. Events whose tragic culmination could be foreseen—and was foreseen—were allowed to work themselves out to the final disaster. The country and the world paid. For a time, indeed, the very reputation of capitalism itself was in the balance. It survived in the years following perhaps less because of its own power or the esteem in which it was held, than because of the absence of an organized and plausible alternative. Yet one important question remains. Would it have been possible even for a strong President to arrest the plunge? Were not the opposing forces too strong? Isn’t one asking the impossible?

No one can say for sure. But the answer depends at least partly on the political context in which the Presidency was cast. That of Coolidge and Hoover may well have made decisive leadership impossible. These were conservative Administrations in which, in addition, the influence of the businessman was strong. At the core of the business faith was an intuitive belief in laissez faire —the benign tendency of things that are left alone. The man who wanted to intervene was a meddler. Perhaps, indeed, he was a planner. In any case, he was to be regarded with mistrust. And, on the businessman’s side, it must be borne in mind that high government office often nurtures a spurious sense of urgency. There us no more important public function than the suppression of proposals for unneeded action. But these should have been distinguished from action necessary to economic survival.

A bitterly criticized figure of the Harding-Coolidge Hoover era was Secretary of the Treasury Andrew W. Mellon. He opposed all action to curb the boom, although once in 1929 he was persuaded to say that bonds (as distinct from stocks) were a good buy. And when the depression came, he was against doing anything about that. Even Mr. Hoover was shocked by his insistence that the only remedy was (as Mr. Hoover characterized it) to “liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate.” Yet Mellon reflected only in extreme form the conviction that things would work out, that the real enemies were those who interfered.

Outside of Washington in the twenties, the business and banking community, or at least the articulate part of it, was overwhelmingly opposed to any public intervention. The tentative and ineffective steps which the Federal Reserve did take were strongly criticized. In the spring of 1929 when the Reserve system seemed to be on the verge of taking more decisive action, there was an anticipatory tightening of money rates and a sharp drop in the market. On his own initiative Charles E. Mitchell, the head of the National City Bank, poured in new funds. He had an obligation, he said, that was “paramount to any Federal Reserve warning, or anything else” to avert a crisis in the money market. In brief, he was determined, whatever the government thought, to keep the boom going. In that same spring Paul M. Warburg, a distinguished and respected Wall Street leader, warned of the dangers of the boom and called for action to restrain it. He was deluged with criticism and even abuse and later said that the subsequent days were the most difficult of his life. There were some businessmen and bankers—like Mitchell and Albert Wiggin of the Chase National Bank—who may have vaguely sensed that the end of the boom would mean their own business demise. Many more had persuaded themselves that the dream would last. But we should not complicate things. Many others were making money and took a short-run view—or no view—either of their own survival or of the system of which they were a part. They merely wanted to be left alone to get a few more dollars.

And the opposition to government intervention would have been nonpartisan. In 1929 one of the very largest of the Wall Street operators was John J. Raskob. Raskob was also chairman of the Democratic National Committee. So far from calling for preventive measures, Raskob in 1929 was explaining how, through stock market speculation, literally anyone could be a millionaire. Nor would the press have been enthusiastic about, say, legislation to control holding companies and investment trusts or to give authority to regulate margin trading. The financial pages of many of the papers were riding the boom. And even from the speculating public, which was dreaming dreams of riches and had yet to learn that it had been fleeced, there would have been no thanks. Perhaps a President of phenomenal power and determination might have overcome the Coolidge-Hoover environment. But it is easier to argue that this context made inaction inevitable for almost any President. There were too many people who, given a choice between disaster and the measures that would have prevented it, opted for disaster without either a second or even a first thought.

On the other hand, in a different context a strong President might have taken effective preventive action. Congress in these years was becoming increasingly critical of the Wall Street speculation and corporate piggery-pokery. The liberal Republicans—the men whom Senator George H. Moses called the Sons of the Wild Jackass—were especially vehement. But conservatives like Carter Glass were also critical. These men correctly sensed that things were going wrong. A President such as Wilson or either of the Roosevelts (the case of Theodore is perhaps less certain than that of Franklin) who was surrounded in his Cabinet by such men would have been sensitive to this criticism. As a leader he could both have reinforced and drawn strength from the contemporary criticism. Thus he might have been able to arrest the destructive madness as it became recognizable. The American government works far better—perhaps it only works—when the Executive, the business power, and the press are in some degree at odds. Only then can we be sure that abuse or neglect, either private or public, will be given the notoriety that is needed.

Perhaps it is too much to hope that by effective and timely criticism and action the Great Depression might have been avoided. A lot was required in those days to make the United States in any degree depression-proof. But perhaps by preventive action the ensuing depression might have been made less severe. And certainly in the ensuing years the travail of bankers and businessmen before congressional committees, in the courts, and before the bar of public opinion would have been less severe. Here is the paradox. In the full perspective of history, American businessmen never had enemies as damaging as the men who grouped themselves around Calvin Coolidge and supported and applauded him in what William Allen White called “that masterly inactivity for which he was so splendidly equipped.”